Cashless Convenience: Exploring Card Payments in Singapore

In the bustling city-state of Singapore, convenience is king, and nowhere is this more evident than in the realm of payment methods. While cash remains a ubiquitous form of currency, the adoption of card payments has surged in recent years, offering residents and visitors alike a seamless and secure way to transact in a variety of settings. In this comprehensive article, we delve into the world of card payments in Singapore, exploring the various types of cards accepted, the benefits they offer, and the widespread acceptance of cashless transactions across the island nation.

Can You Pay By Cards in Singapore?

Yes. You certainly can. Most merchants in Singapore accept credit and debit card payments, especially when you dine or shop in malls and restaurants. However, do carry some cash with you for smaller purchases in places like hawker centres or neighbourhood stores.

Types of Cards Accepted

Singapore boasts a highly developed financial infrastructure, with a wide range of card options accepted for payment in virtually every sector of the economy. Major credit card networks such as Visa, Mastercard, and American Express are widely accepted at most retailers, restaurants, hotels, and entertainment venues. Additionally, popular debit cards issued by local banks such as DBS, OCBC, and UOB are also prevalent, offering consumers the convenience of direct access to their bank accounts for seamless transactions.

Beyond traditional credit and debit cards, Singapore has embraced the digital revolution with the proliferation of mobile payment solutions. Apps like Apple Pay, Google Pay, Alipay, Samsung Pay, and GrabPay allow users to link their credit or debit cards to their smartphones, enabling contactless payments at a growing number of merchants across the island.

Benefits of Card Payments

The shift towards card payments in Singapore has been driven by a multitude of factors, including convenience, security, and rewards. Unlike cash transactions, which require exact change and carry the risk of loss or theft, card payments offer a hassle-free alternative that eliminates the need for bulky wallets and loose change. Moreover, many credit and debit cards come with built-in security features such as chip technology and PIN verification, providing added peace of mind for consumers concerned about fraud or identity theft.

In addition to the inherent convenience and security of card payments, many issuers offer enticing rewards and perks to cardholders. Cashback, travel miles, dining discounts, and exclusive promotions are just a few examples of the benefits that cardholders can enjoy when using their cards for everyday purchases. These rewards programs incentivize spending while helping consumers maximize the value of their purchases—a win-win scenario for both cardholders and merchants alike.

Widespread Acceptance

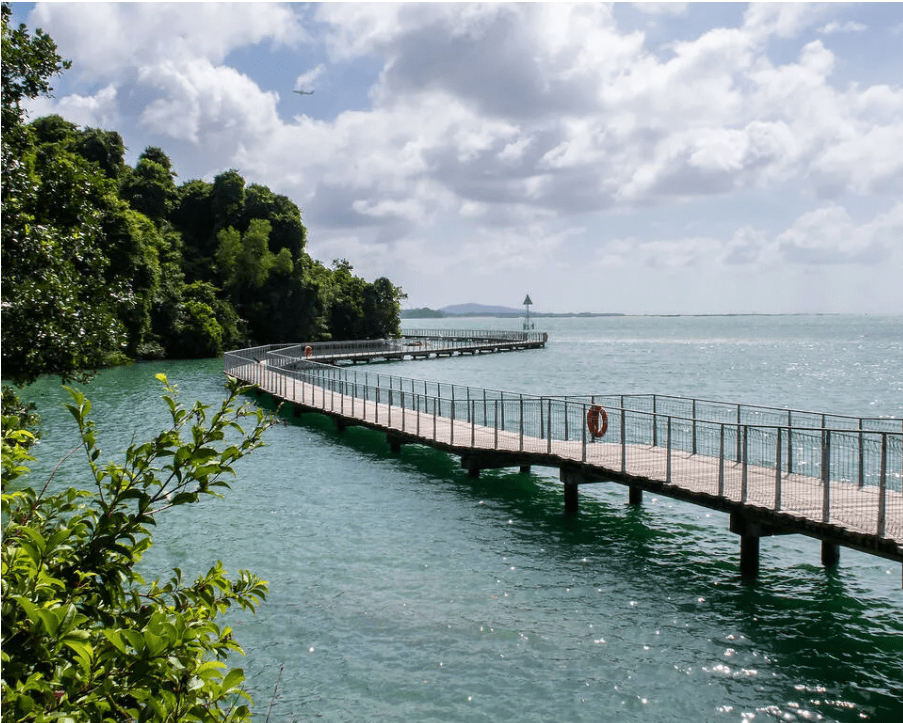

One of the most notable aspects of card payments in Singapore is the widespread acceptance of cashless transactions across the country. From hawker centers and street vendors to luxury boutiques and electronic stores, card terminals are ubiquitous, making it easy for consumers to pay with plastic wherever they go. Even small businesses and mom-and-pop shops have embraced card payments as a convenient and efficient way to serve customers in an increasingly digital age.

Moreover, Singapore’s robust public transportation system has also embraced cashless payments, with the introduction of contactless payment options for buses, trains, and taxis. Commuters can tap their credit or debit cards on fare readers to pay for their rides, eliminating the need for physical tickets or cash fares—a testament to Singapore’s commitment to innovation and efficiency in all aspects of daily life.

In conclusion, card payments have become an integral part of everyday life in Singapore, offering residents and visitors alike a convenient, secure, and rewarding way to transact in a variety of settings. With a wide range of card options accepted at virtually every merchant and the widespread adoption of contactless payment solutions, cashless transactions have become the norm across the island nation. As Singapore continues to embrace the digital economy and drive innovation in financial technology, the future of card payments looks brighter than ever, promising even greater convenience and efficiency for all who call this dynamic city-state home.